Against the backdrop of a more conservative economy, we talked to some of our roaster partners about the coffee consumer trends they’re seeing in their cafes, wholesale programs, e-commerce, and their regions at large. If 2021 represented a post-pandemic boom with back to normal as its slogan, what does 2023’s new normal look like now that that boom has slowed? And, lacking a crystal ball, what does the roasting sector expect for the future?

Price sensitivity is real

As the Federal Reserve continues to raise rates and many business sectors—most notably the tech sector—initiate mass layoffs to cut costs, the economy at large seems to be tightening its belt. Specialty coffee is no exception, so what does this belt-tightening look like for the client bases of top-tier specialty coffee roasters?

Scott Carey, managing partner of SUMP Coffee in Nashville, TN and Saint Louis, MO, definitely sees the trend of customer cost-cutting where possible. “I’m beginning to see some price sensitivity in some segments of our market,” he says. “The price of coffee has crept a little too high for certain customers and some of them are starting to pause, slow down, or alternate $25 10oz speciality bags with some $11 grocery store coffee.”

The finer things: differentiation & staples

According to most of the roasters we spoke to, customers are seeking more differentiation between their higher-priced purchases and their regular purchases. In other words, they’re looking for offerings that are very clearly delineated as special or else focus on less expensive coffees.

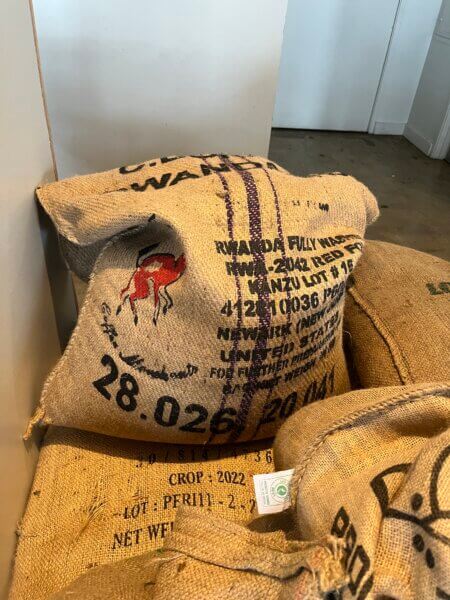

“We’ve done well balancing a small amount of limited-release or featured coffees against a higher volume of coffee staples that primarily get used for our wholesale program,” says Greg Rodrigue, co-owner Hey Coffee Co. in New Orleans, LA. “For coffees that we promote on the retail end, we buy 1-2 bags of something special from different producers or growing regions and feature 2-3 at a time seasonally. Those coffees are typically in the 86-89 point range and help us start conversations about coffee, growing practices, and coffee exporting history and global trade with customers.”

When discussing customer price sensitivity, Carey of SUMP noted that “not everything can be a yellow tip natural-process Gesha,” the kind of flashier novelty coffee that their current customer base is most willing to shell out for.

Evan Wood, director of coffee and green buyer at Night Swim Coffee in Charlotte, NC shared a similar trend. Even though he says their year-round blends sell 4-5 times more than single origin or filter menu options, “experimental coffees with catchy or inventive processing names sell better than ‘normal’ coffees.”

Is this about flavor, or branding? Wood says that “tasting notes are enormous influencers in coffee sales,” so it’s likely branding as much as the flavor profiles that come with these nouveau offerings. “Limited or exclusive products, restricted timeline availability, and association with an overall brand drive sales,” he adds, showing how product delineation is a hugely important force in the current market especially for premium specialty.

Areli Barrera de Grodski, co-owner and green coffee buyer at Little Waves Coffee Roasters in Durham, NC sees echoes of the same in her customer base, but is happy to see that clients are stalwart to the classics as well. “In retail there’s a mixture of piqued interest in differently fermented coffees and sticking to those traditional, beautiful mild coffees,” she says. “I do find our ‘unique’ origins make waves in our market. I’m also noticing that our customers crave variety.”

Wholesale: price sensitivity & support packages

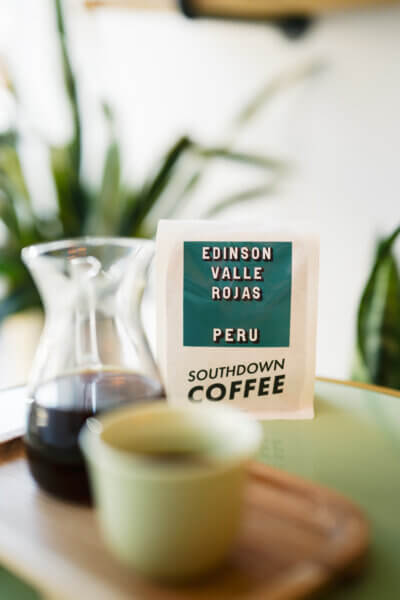

Mark Boccard, founder and coffee director of Southdown Coffee in Long Island, NY, says it’s a tricky time for wholesale business in his region. “Many people are looking for extremely cheap coffee and free equipment,” especially in Southdown’s more traditional local market. “Finding accounts who understand the value of good coffee and are willing to charge accordingly can be difficult here,” he says.

Similarly, Wood of Night Swim sees the primary wholesale demand right now as support packages over quality coffee. “Potential wholesale partners are looking not only (or even primarily) for coffee quality,” he says. “The largest driver of wholesale volume is support. Equipment maintenance, education, vendor support, consultation, convenience of delivery or roasting schedule, and private-labeled bags.” Companies with training spaces for wholesale clients and on-staff techs have set a strong precedent in his region. “I don’t see it as a negative or a positive,” he says, “just a set of expectations that we’ve had to navigate, be flexible with, and adjust on a case-by-case basis.”

Between the supply chain difficulties that dominated 2022 and the high and volatile coffee prices that followed, Rodrigue of Hey has had to raise wholesale prices. Using communication, he’s been able to mitigate the price-sensitivity in his more specialty-friendly region which offered a little more slack for price rises. “Most of our wholesale partners have stayed with us through the ups and downs. I gave each partner a month’s heads up, as well as a phone call or in-person conversation to explain why there were price fluctuations.” His aim was to maximize transparency on their costs, challenges to producers, and increases in shipping costs. “If and when we have more price changes in the future, I will repeat.”

Prices aside, Barrera de Grodski of Little Waves sees one fairly traditional demand on the wholesale side: blends, primarily dark roast. “Our newsletter gets folks excited when we have fruity naturals or funky fermented coffees to share with them, but our top sellers are still the milds.”

E-commerce: leveled off, but still up

E-commerce experienced a massive bump when the pandemic closed down shops and slowed grocery business. It’s since leveled off, but still a larger source of volume than pre-pandemic as people settle into their new version of normal.

Boccard tells us that “e-commerce has cooled a bit sine 2020/21, but I do think the pandemic added to overall online demand,” which had already started to grow pre-pandemic.

He’s also seen some regional movement in their e-commerce customer base. “We ship all over the US, perhaps due to former customers moving around the country and looking for a taste of home, and hopefully also based on internet publicity through social media or online publications.” In other words, it’s not just customers who have moved to new regions, but also shifting patterns in how online coffee buyers find new products to try.

“In e-commerce, I think everyone across the board saw an upward spike during Covid,”says Carey of SUMP. “I think that’s peaked, but customers didn’t go back to in-store purchases exclusively. So there was a climb during Covid and a plateauing or leveling off at close of 2022.”

Wood of Night Swim sees e-commerce trends falling into similar patterns as retail: limited releases, seasonal specials, and overall well-differentiated specials move best in the high price tier, while year-round blends still sell more volume. As in retail, flavor notes and novel-sounding processing methods and/or varieties drive sales.

Fellow North Carolinian Barrera de Grodski also finds e-commerce trends running parallel to retail trends: interest and curiosity in nouveau profiles and processing methods alongside continued dedication to classic washed profiles from traditional origins.

Trends seem more broad than regional

The partners we spoke with overall felt the trends were not unique to their specific regions.

“Difficult for me to say for sure, but I would imagine this situation is more broad,” says Rodrigue of Hey.

I think the above points are not unique to us and that the home market is where real growth is,” says SUMP’s Carey. He feels especially that the trend of consumers seeking “unicorns, as we like to call alt-process coffees,” is broad-scale.

“Charlotte is a pretty current market,” says Wood of Night Swim. “I would say that these are pretty general and broad trends.”

Boccard of Southdown’s market is different from more current specialty markets like Wood’s, and he knows it and embraces it. “Long Island is definitely a tough market for specialty coffee, but not impossible. Part of what makes it a good business proposition is the fact that most people are still unfamiliar with what the industry has been doing for the last 10-20 years.”

Rather than trying to tell his market what they like, he leans into doing what they like better than non-specialty companies. “Instead of trying to convince someone with no specialty context that they like super light-roasted natural Ethiopias on drip, we just give them the best Central they’ve ever tasted, brewed perfectly. Most likely they will see the difference sooner or later.”

Barrera de Grodski of Little Waves does see their experience as broader trends, but they’re in an innovation-friendly area that’s been spared the brunt of the price sensitivity. “It’s part of a broad trend, but I also think that because we’re close to so many big, innovative roasters, our customer base is ready for great coffees and ready to pay for them,” she says. “We are well staged for adventurous coffee drinkers, but I love that the beautiful, clean milds are where the repetition happens.”

Maintenance over growth

As the economy slows, it’s a time where businesses are trying to hold strong in what they do best rather than aim for expansion.

“Lately we’ve had more of a focus on maintenance than growth,” says Rodrigue. “We want to provide a high quality consistent product and customer service, and do so with a personal approach.” His team hopes that by focusing on that, growth will come naturally as a positive side effect.

Boccard of Southdown levels up about the difficulty of the current moment, no matter who or where you are in coffee. “These are extremely challenging times for nearly everyone I’ve talked to in the industry. Inflation is ongoing and each section of the supply chain has unique challenges to overcome.” He’s really come to understand the value of open communication with supply chain partners and his team while navigating these times.

Despite the difficulty of the moment, he’s maintaining optimism and continues to believe in the promise of specialty coffee—”better coffee gets higher prices, farmers and workers make more money, cafe customers in the US drink better coffee, so everyone wins”—though he knows it’s neither easy nor simple. “Having been in the industry over a decade in a variety of jobs, I can say that I do see a positive trend for folks on all sides: you just have to zoom out and power through these tough times.”

It certainly won’t be the first time the coffee industry has done so, and come out stronger for it.

| Interested in sourcing coffee with us? Reach out at info@redfoxcoffeemerchants.com. To learn more about our work, check out our journal and follow us on Instagram @redfoxcoffeemerchants, Twitter @redfoxcoffee, Spotify, and YouTube.

|